The Delta epidemic has "peaked", and the market should worry about a sharp rebound in U.S. Treasury Yields.

Goldman Sachs analyst Kolanovic believes that with the Fed’s turn to hawks and the overvaluation of the Delta’s new crown variant, U.S. Treasury yields and cyclical stocks have bottomed out last week.

After the global new crown epidemic broke out last year, with the Fed's large-scale quantitative easing policy and extremely low interest rates, U.S. stock growth stocks began to be sought after. Cyclical stocks and value stocks such as energy and banking suffered heavy losses. As interest rates continued to fall, U.S. Treasury bond yields also allowed long-term Treasury bonds to climb.

Subsequently, under the expectations of the Fed's tightening policy at the beginning of the year, and supply-side inflation caused by the tight supply of raw materials and energy, and as the economy gradually opened up and returned to normal, value stocks rebounded during the year. In the first half of the year, US long-term Treasury yields also soared at an unprecedented rate.

But with the spread of Delta Air Lines' new crown variant, people began to worry that the economy would resume the blockade. In addition, the dovish and hawkish volatility of the Fed in the first half of the year also gave U.S. debt a respite. Growth stocks rose again in this delicate atmosphere, and the Nasdaq 100 index once also hit a new high.

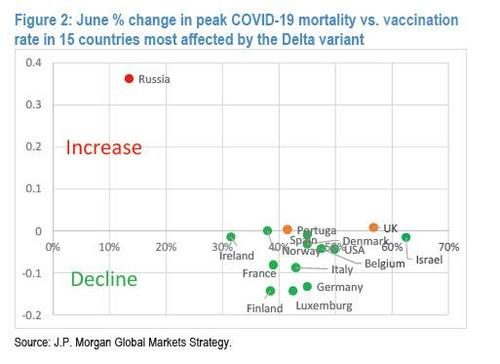

However, even if the value still has not risen, Kolanovich, a flux analyst at JPMorgan Chase, still believes that value stocks will soar and growth stocks will fall. In addition, he also believes that the market has seriously exaggerated the impact of delta variants, and he also bet all his credibility on the emergence of the commodity super cycle.

Of course, Kolanovic’s extreme views have not been recognized by the market, and the degree of differentiation between energy stocks and commodities has reached a record high, but this has not stopped Kolanovic from insisting on this conclusion. In a report published yesterday, he said: U.S. Treasury yields and cyclical stocks have bottomed out last week and will return to an upward trajectory for the remainder of the second half of this year.

In addition, regarding the issue of holdings, Kolanovic said that no matter how high the current stock positions are, at best they are only historical averages. Although the total exposure of major brokerages and brokerages in hedge funds is record-breaking, and retail investors are clearly speculating in stocks, Kolanovic still believes that people's holdings are still very low.

Kolanovic wrote in the report that although his estimates of stock positions have been rising, they are still close to historical averages compared to their 10-year histor

Kolanovic also stated that most of the historical corrections and corrections will occur when stock exposures are higher than the 80% percentile of historical highs. In some cases, risk exposures can be within one year. Stay in the 100% percentile. There will be major corrections and callbacks.

Regarding risks, Kolanovic believes that the next potential risk factor is a substantial increase in bond yields (related to shrinkage, inflation, etc.).

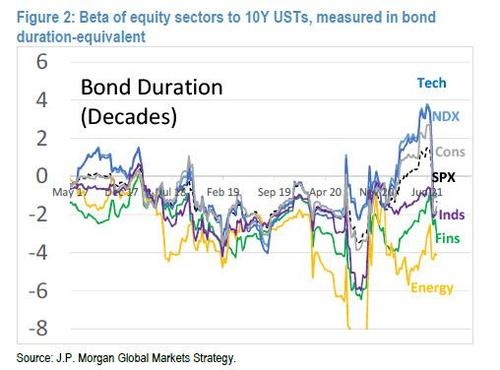

In terms of different industries, the beta coefficient of the technology sector in July was 4, and the beta coefficient of the financial sector was -3. In other words, if the price of 10-year Treasury bonds rises by 1%, technology stocks rise by 4%, and financial stocks fall by an average of 3%. Therefore, soaring bond yields will cause bond prices to fall, which will benefit cyclical and value industries such as finance, and have a negative impact on growth industries such as technology.

Even so, although Kolanovic believes that Treasury bond yields will rise sharply, the risk of a sharp decline in technology stocks leading to a sell-off in the broader market is not high. But compared with technology stocks, they prefer cyclical stocks, international stocks and value stocks.

In the end, Kolanovic said that if the risks of holding positions and rising yields (caused by the taper) are controlled, and the expected blockade brought by the delta variant does not resonate with most investors, then the market will have nothing to do. Worried. Things are done.

In addition, Kolanovic believes that another major risk for technology growth stocks is the existence of bubbles in some industries, such as renewable energy, electric vehicles, digital currencies, etc., and believes that their valuations will eventually converge with traditional cyclical stocks and values. Stocks, but these trends will continue before the bubble bursts. Even if the bubble bursts, it will not be enough to shake the entire market.