The stock market is complex. There isn't one or a specific factor that influences the market as a whole; different factors influence the market in different situations. A lot of people are involved in this market which makes it difficult to agree on what affects the market and what doesn't. Here is a list of a few factors that, independently or together, can influence the market.

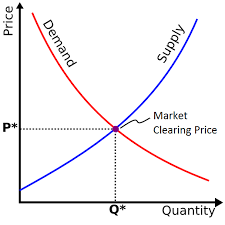

1. Demand and Supply

Demand and supply are the basic market drivers. They are the main reason why prices fluctuate in the stock market. For example, if a share has a lower supply than its demand in the market, the price of that share will go high. Likewise, if a share's supply is more than the demand in the market, the price will come down. Moreover, if the supply exceeds the demand, the price will most likely fall.

2. Bank Rates

A bank's credit policy affects the share prices. For example, if the Central bank increases the bank rates, the loan rates by the commercial banks will also increase, lowering the amount of loan given out, and likewise, the stock price of the share will fall because fewer people want to invest in the market.

3. Financial Stability

Another factor that affects the prices in the stock market is the financial condition of a company. It is a simple rule; the better the condition, the more the investors are willing to invest, and likewise, the higher the prices because of greater demand. Whereas, if a company is not doing well financially, the investors will sell their existing shares of that company, look out for new and better companies, likewise lowering the demand, and the prices will fall.

4. Dividend Rate

The rule here is simple: the higher the dividend rate, the higher will be demand for shares of that company, and likewise, the prices will go up since more investors would want to invest in the company. On the other hand, if the dividend rate is not up to the expectation of the buyers, they will not invest in the company’s share; likewise, fewer investors would pull the prices of the share down.

5. Inflation and Deflation

Inflation means increased circulation of money in the country. More money means that people have access to a higher level of finance, and they are willing to invest in them somewhere. Most people invest their finances in the stock market. This increases the demand, and likewise, the prices go up.

Whereas, in the case of deflation, there is a shortage of money in the market. This makes people reluctant to spend or invest money. Due to this, the demand for shares decreases, and the share prices fall.

6. Role of the government

The government also has control over the fluctuation of prices in the stock market. For example, when the government increases its investment or raises capital from the public, the prices of the stocks increase. On the other hand, if the government does not participate in the industry, it causes a factor of discouragement, and the prices of the share fall rapidly.