It is essential to know when a stock is overvalued and when it is undervalued. There are some signs and factors that can help you predict so. Keep reading to find out!

PEG Ratio and Dividend Adjusted PEG ratio

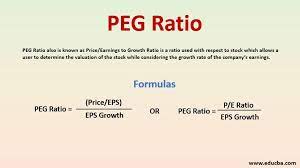

P/E is the price-to-earnings ratio, and PEG is the price/earnings-to-growth ratio. The difference between the PEG ratio and Dividend Adjusted PEG ratio is whether the stock pays a dividend or not. If it does, use the Dividend Adjusted PEG ratio.

The price/earning-to-growth and dividend adjusted price/earning-to-growth help in deciding the true and accurate value of a stock, i.e., if it is undervalued or overvalued.

Always consider the past few years to predict the upcoming years. For the PEG ratio, look at the predicted growth in earnings per share once the tax has been calculated. Once done, consider the price-per-earnings ratio on the share value. Here is how you can calculate it:

P/E ratio ÷ company's earnings growth rate

As mentioned earlier, if the stock pays a dividend, use the following dividend adjusted PEG ratio:

P/E ratio ÷ (earnings growth + dividend yield)

Price-to-Book

P/B or price-to-book is another ratio method that helps evaluate a company’s share price. In this ratio, the company’s shareholder’s equity per share is equal to book value per share. P/B incorporates the share price and book value per share. The higher the P/B, the more overvalued the stock will be. The formula for price to book is:

Price per share ÷book value per share

3 Factors that can Evaluate if a Stock is Overvalued

1. Comparing Growth Rate

Always use the price-to-earnings ratio of stocks to compare the growth rate. Calculating the P/E can be done by dividing the price of a share by the earnings per share. This gives you a ground to compare the result with the growth rate.

If the result of the P/E is higher than the growth rate, the stock is overvalued.

2. Consumer Demand

Measuring consumer demand is another way of measuring whether a stock is overvalued or not. Any company that produces goods and services that others want is a valuable company. The reason being that companies with increasing demand on Main Street mean an increasing share value on Wall Street.

To gain better insights about a company’s future over the next 2-4 years, look for its company earnings reports and sales numbers in comparison to the consumer demand.

The better the company is doing, the higher the consumer demand on Main Street is, the more the stock will be overvalued.

3. P/E vs. Competitor’s P/E

Analysis of the competitor is essential as it gives a beneficial ground for evaluating specific stocks. Look around for competitor to your stock that is equal enough to compete on a comparable financial foot. Once found, compare your price-to-earnings ratio with your competitor’s price-to-earnings ratio.

If your stock’s price-to-earnings ratio is higher than that of the competitor’s, your stock is overvalued and vice versa.