Stocks are becoming increasingly popular in the investment world. But are they secure? Read below to find out!

Introduction

Investors highly prefer investing equity in stocks nowadays. There has been increasing awareness of stocks and how the stock market works. However, investors still lack knowledge about the stock world and may face volatility as the stock market is unpredictable.

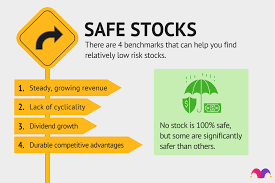

Safe might not be the right word to use when discussing the stock market, as it depends on multiple other variables. But it can be said that stock markets are uncertain and risky.

It is a place where investors can either enjoy profits or incur losses. Even though the stock market is quite accessible for the public, it can work both ways.

Is The Stock Market Safe?

No, stock markets are not safe for both amateurs and professional investors. Why? Because both groups can lose a significant amount of money in a short period. If you are looking to invest somewhere for the short term, the stock market is not the right place to go.

Stock markets are unpredictable for the short-term but might be predictable for long-term investments. The return generated in the long run can also be higher and much better.

Honest advisors will admit that it is not easy to predict how well a particular stock will perform. They cannot tell the stock market trends today, tomorrow, next week, or even next year. Hence, it is risky and might not be a safe place for people looking for short-term solutions.

Can You Lose More Than What Is Invested?

Yes, investing comes with a baggage of risks and ups and downs. The value of stocks can not be decided or predicted by an individual. The market determines the worth of a stock, and that value might not be stable.

An investor can lose more than what was initially invested. However, it depends on the type of account they have and the type of trading they do.

You can not lose more than what you’ve invested in case of a cash account but, if you have a margin account, you can lose more. In a margin account, you borrow money as a loan from the broker, which involves interest. If, for instance, the stock value falls, and you lose your money them you will be paying the broker the borrowed money, including the interest.

Takeaway

The term ‘stock market’ may seem simple, but it is a highly complex process to go through. Stocks involve risk, making it unsafe for people looking to invest for a shorter period.

Stock values are not pre-determined and rely entirely on the market. If a stock you own drops to the value of zero, it will automatically be delisted from the stock exchange, and you will lose all that you had invested in that stock initially.

Hence, you can either win or lose money in stock trading. If you are

willing to take the risk, you can read up on how the market works and invest

wisely.