Investment companies attract investors in various forms, no matter what they are looking for. But even though they seem to have everything that investors need, from investment to profitability and so on, they are not the same. Investment companies aim to help investors invest their moneys in the provision of different financial securities, which can take the form of stocks, bonds or other types of asset classes. Most investment companies provide closed-end or open-end funds, which usually called mutual funds.

Nevertheless, as we all know, investment is risky when mainly these investment companies invest for you. Therefore, these investment companies establish financial regulations in order to protect investors from fraud and infringement

Investors should have knowledge of the Investment Company Act of 1940, which stipulates how investment companies should invest their capital and how to manage their capital. These companies must be registered with the U.S. Securities and Exchange Commission (SEC). And to ensure the protection of investors, all the information must be fully transparent to regulators.

Due to the wide variety of investment companies, every investor needs to understand multiple types of it.

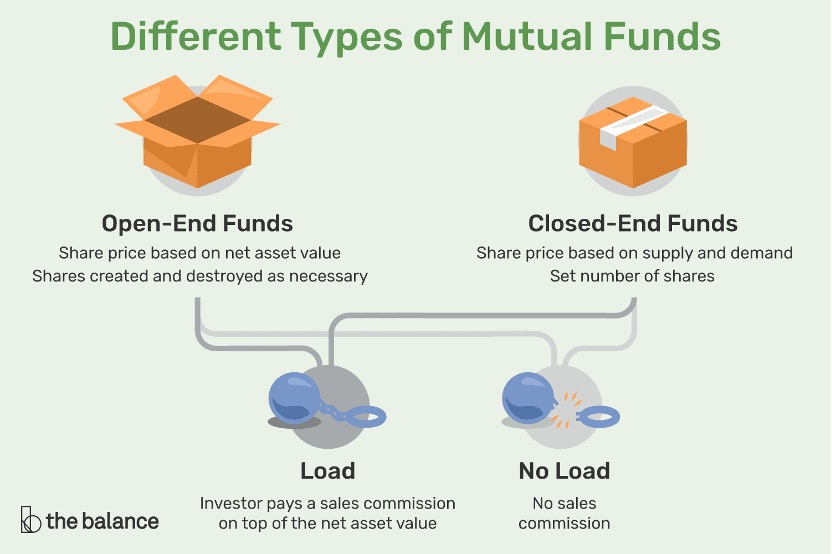

1. MUTUAL FUNDS (OPEN-END)

You probably heard about mutual funds since it is the most common form of an investment company. If you have 401(k) plan, you may already invest in a mutual fund. Since the 401(k) typically offers you a choice of several investment options range from aggressive growth funds to conservative income funds. Now let’s see how it works!

A mutual fund is a pool of money provided by individual investors, companies, and other organizations, and is one of the easiest and least stressful ways to invest in the market. A fund manager is hired to invest the cash the investors have contributed, and the fund manager's goal depends on the type of fund; a fixed-income fund manager, for example, would strive to provide the highest yield at the lowest risk. A long-term growth manager, on the other hand, should attempt to beat the Dow Jones Industrial Average or the S&P 500 in a fiscal year, although very few funds achieve this.

A mutual fund is both an investment and an actual company. This dual nature may seem strange, but it is no different from how a share of AAPL is a representation of Apple Inc. When an investor buys Apple stock, he is buying partial ownership of the company and its assets. Similarly, a mutual fund investor is buying partial ownership of the mutual fund company and its assets. The difference is that Apple is in the business of making innovative devices and tablets, while a mutual fund company is in the business of making investments.

2. MUTUAL FUND (CLOSED-END)

A close-ended mutual fund has a specified tenure and a fixed maturity date. At the end of the tenure, which can be three, five or ten years long, the scheme is dissolved and the money is returned to the investors. Alternatively, the fund may be converted to an open-ended plan. Closed-end funds have a set number of shares issued to the public through an initial public offering. Because these shares trade on the open market and closed-end funds don't redeem or issue new shares like a typical mutual fund, the fund shares abide by the laws of supply and demand and normally trade at a discount to the net asset value.

Investors may want to know what a close-ended mutual fund’s advantage is. A close-ended fund lets the fund manager manage the corpus more efficiently because the funds raised by the scheme are locked-in during the tenure. This allows the fund manager to create a suitable long-term investment strategy for the scheme. It relieves the pressure of delivering returns amid short-term pressures. Fund managers may analyze different assets and select those that have the best growth potential. Some of these assets may not offer much liquidity in the short-term but may have the potential to deliver excellent returns when held over a longer term.

3. UNIT INVESTMENT TRUST (UIT)

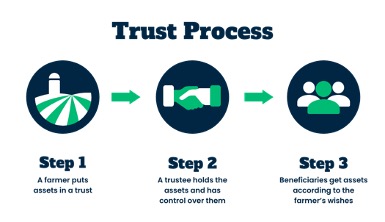

Unlike mutual funds, unit investment trust (UIT) is effectively an investment firm or company that bundles investments, typically stocks or bonds, into one unit. These units are sold to investors to hold onto for a predetermined period of time. The goal is that the investments will appreciate and produce income. Here, investors can earn interest from dividends and bonds, but it will only make a profit from the capital appreciation if the UITs holdings have fully matured. Some UITs are designed to mature in five years or so. Others are long-term investments that won't mature until 30 years after creation.

Conclusion

The price of a closed-end fund fluctuates according to supply and demand, as well as the changing values of its portfolio's holdings. Closed-end fund is subject to volatility and has less liquidity than open-end funds. Investors who want to have a long-term investment may choose UIT.