Crypto markets, specifically Bitcoin, have been shrouded in a cloud of worry and panic for about 3 months now. Every guess and prediction continues to fail, every rally is followed by another crash, BTC is struggling to climb back to $40k. Once the torchbearer of optimism, Bitcoin is now the primary reason for everyone's concern, and its effect can be observed in market sentiment.

Fear and Greed

Sentiment is one of the biggest driving factors in the crypto markets. Be it the news of Ethereum's new upgrade or the rejection of BTC for purchase due to environmental hazards by a certain influencer “cough cough”; people hear and behave instead of looking at the numbers first. Such movements depict the influence people have on a cryptocurrency and vice versa.

Thus, Fear and Greed index is the best indicator when it comes to understanding market sentiment. The numbers drawn on this index are a result of multiple other indicators' values combined together.

Presently, the Bitcoin market is not in a good shape. On the index, the king coin registered a rating of 25, which translated to extreme fear. BTC has been flickering in that range for a couple of days now.

Why does this matter?

This index has proved to be comparatively accurate than other indicators. Every time the index bottoms, the coin rallies. If you observe the index from March to April 2020, you can see that the index was at its lowest that year at a mere 9 points. This indicated that the market was in extreme fear back then. At the moment the situation is almost similar. The index is back in the 10-20 zone and the coin dictates extreme fear in the minds of investors.

However, this can also be considered as a good sign. As said, when the index falls, the coin soon after picks up a bullish pace and shoots up. And since actively the market is gripped with fear, the only way to move is up. Such a spot is also considered a good time to buy as at the moment Bitcoin is at its lowest average trader returns in 14 months.

Also in the last few weeks capital has been flowing back into the Bitcoin market from stablecoins. This observation comes from the Stablecoin Supply Ratio (SSR) Oscillator which tanked a couple of weeks ago and just started trending up in recent weeks.

Time to buy Bitcoin?

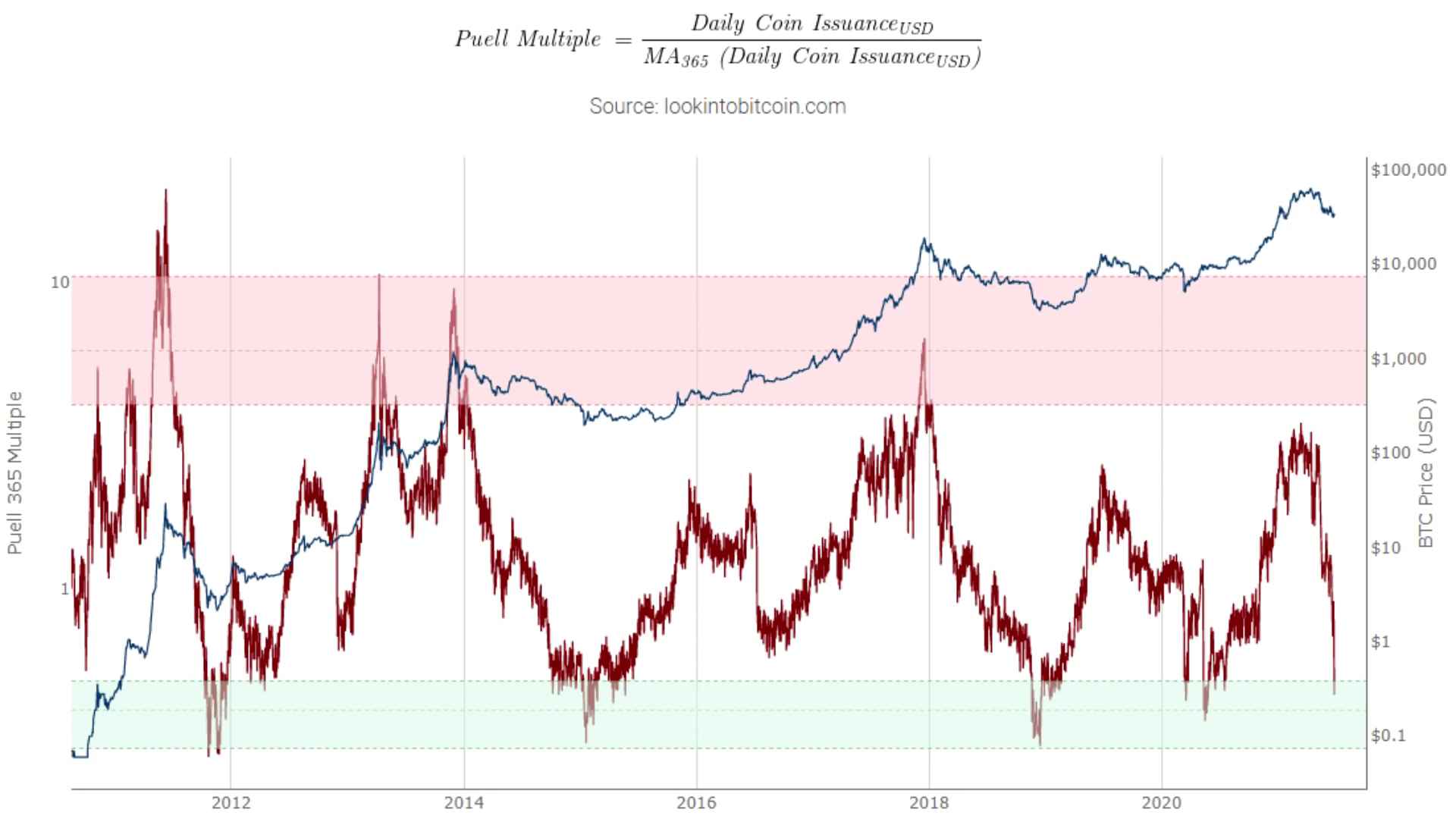

At the moment, Bitcoin has consolidated its movement above $30k. The king coin tarnished every hope recently of making a bull run, and short-term holders ended up losing millions of dollars. But an important indicator-The Puell Multiple brought some good news. According to the indicator, BTC was in the right spot to’buy’.

Historically, the indicator has only ever reached the green buy zone 5 times since Bitcoin’s inception. The most significant instances out of all of these were the 2012 drop, the 2018 fall, and the most recent 2020 crash. During each of these events, Bitcoin indicated solid buy signals and then went on to rally.

With the coin being in a similar situation, the optimism cannot be ignored. And since the indicator has been historically accurate in this matter, this buy sign can be ignored at a hefty cost.

Who else is buying?

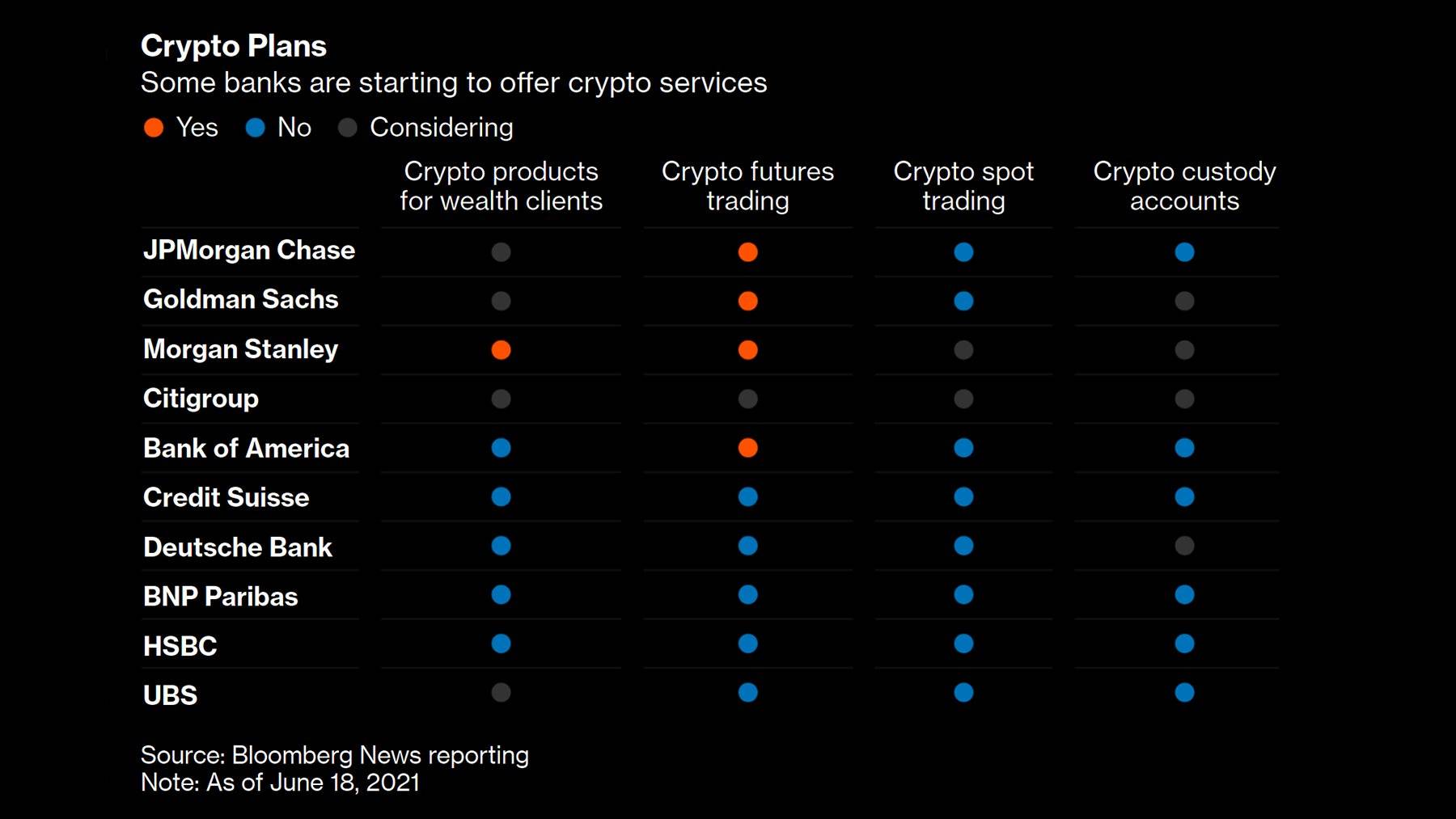

Recently, despite the controversial XRP lawsuit, banks have entered the crypto markets, and most specifically Bitcoin. The numbers showed that names such as JPMorgan Chase, Goldman Sachs, Morgan Stanley, and Citigroup have already dipped their toes into the crypto markets and plan on expanding them further.

Whales have long influenced market movements. A recent report by Santiment noted that “Bitcoin addresses holding 100 to 10,000 BTC added a total of 90,000 BTC in the last 25 days and was valued at $3.38 billion.”

Also on the topic of ETF’s applications for approval gaining traction in the United States of America, Davis said, “It’s not a matter of IF they’ll approve Bitcoin ETF, it’s a matter of WHEN they’ll approve it”

And while the US SEC is yet to make a decision, approved BTC ETFs have performed well. Even though it is yet to happen, that day might not be far away.

Additionally, active addresses have been rising, which is a positive sign for Bitcoin.

The Stablecoin Supply Ratio (SSR) Oscillator bottomed and has been trending up in recent weeks, indicating that capital has been flowing back from stable coins into #Bitcoin.