Looking for the best approaches that can make your long-term stock investments profitable? Read ahead to explore.

Investment can sometimes become tricky; the best investment strategy may not always be the one that will bring you high returns. Before deciding where and how to invest in your stocks, there are many factors that need to be studied and analyzed.

Review the available investment styles and strategies, and choose the one that suits you best. It is best to be satisfied and satisfied with the strategy you have adopted, because you will be engaged in this business for a long time.

What are the best investment strategies?

Depending on your risk tolerance and financial goals, you can choose from five different strategies. You may want to invest directly in high-growth stocks, or you may want to protect your assets through bonds. Let's talk about basic strategies that can help you generate positive returns.

Active transaction

Active trading is complicated; if you understand the correct method, you may make a lot of money. If you want to conduct active trading, you need to use research tools that focus on the technical analysis of stock issuing companies. With this tool, you can study the changes in stock prices.

In order to effectively conduct active transactions, you need to use the price data provided by the charting platform or exchange to study price patterns, changes and market trends. In this way, you can predict future results and increase your chances of high returns. This strategy is suitable for short-term investments.

If you want to make long-term investments, you can use momentum investment strategies under active trading. This strategy states that you invest in stocks with random prices and wait for the momentum of future price trends to increase. You can then sell these stocks at a price higher than the purchase price.

Growth investment

Growth strategies need to check and analyze the financial factors and statements of listed companies. Your main focus should be to find a company whose metrics depict profitable growth or short-term growth potential.

This strategy requires you to build a portfolio of ten or more stocks; however, if you are a beginner who wants to start small, then you need to conduct thorough research. The valuation of the company's stock determines whether it is worth buying.

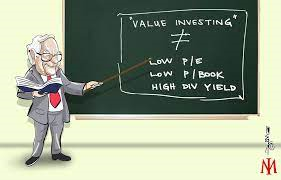

Value investment

Investors investing in ETFs or mutual funds can use this strategy by focusing on value stock mutual funds. This means that you may want to find stocks that are sold at a discount under value investing.

Instead of spending time looking for value stocks, you can buy exchange-traded funds, actively managed funds, or index funds that hold value stocks. However, these securities also involve risks, so you may need to look at things clearly before investing money in them.

Buy and hold

In this strategy, you can buy securities and hold them for a long time. This requires patience and commitment. The goal is to avoid short-term fluctuations by relying on long-term returns.

This may even increase the overall net worth of your investment portfolio. Therefore, choose the strategy that suits you and your goals in the best way.