In today's world, health insurance is more of a necessity than an accessory. When you have a reliable health insurance plan, you can spend your whole life worry-free. But how do you know which health insurance plan is the best?

Well, it all depends on your situation. Whether you want to buy health insurance for yourself, your family, or for company staff, budget, and underwriting needs, there are different types of health insurance plans. Here, we will explain the standard plan in detail to understand which plan to buy. let's start!

Types of health insurance

Although there are several different types of health insurance plans, the most commonly used are:

Preferred Provider Organization (PPO) program

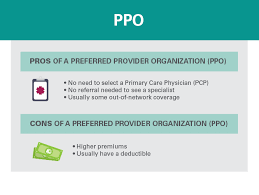

The PPO plan is the plan most frequently purchased by the company. Employees covered by this plan can seek medical care from doctors, clinics or hospitals on the insurance company's preferred provider list.

This plan is great because it allows you to choose a hospital or doctor from the list of insurance companies, and you don’t need a referral from a primary care institution to see a specialist. However, these benefits will translate into higher monthly premiums and deductibles before you are eligible for the plan.

Health Maintenance Organization (HMO) Program

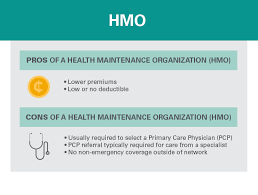

The health maintenance organization plan has a network of healthcare providers and facilities to provide services to those who purchase the plan. With this plan, you usually have to go through a primary care doctor or agency, who can then choose to refer you to a specialist.

Although the plan involves less paperwork and hassle, it gives you less freedom to choose a healthcare provider. The advantage is that these plans usually have no or very low deductibles and low monthly premiums.

Health Savings Account (HSA) Eligible Plan

These PPO plans are designed to be used in conjunction with a health savings account (HSA). A health savings account allows people to save money specifically for medical expenses.

These plans are especially beneficial if you want to control when and how to save or spend money related to medical expenses. The disadvantage is that you must pay a deductible, and if you withdraw anything other than medical expenses, you must pay a fine.

Conclusion

Health insurance has a variety of plans for you to choose according to your healthcare needs and preferences. Then why wait? Buy a health insurance plan now!